By Kate Clark

Apple (NASDAQ: APPL) has had a great 2018.

Even as the other FAANG stocks slumped, the trillion-dollar electronics company has continually satisfied Wall Street with quarter-over-quarter revenue growth. But will Apple’s momentum continue after it reports its fourth-quarter earnings on Thursday?

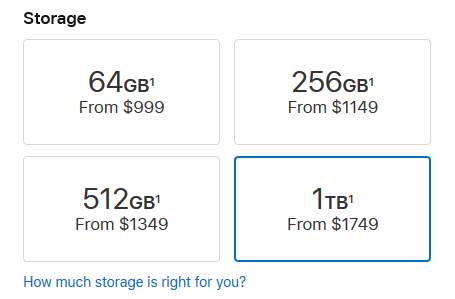

The consensus, so far, is yes. Apple is expected to post revenue of $61.43 billion (earnings per share of $2.78), an increase of 17 percent year-over-year and GAAP EPS of $2.78, according to analysts polled by FactSet. Investors will be paying close attention to iPhone unit sales, which account for the majority of Apple’s revenue, as well as Mac sales, which accounted for roughly 10 percent of the company’s revenue in Q3.

The company reported its Q3 earnings on July 31, posting $53.3 billion in revenue, its best June quarter ever and fourth consecutive quarter of double-digit revenue growth, the company said.

At today’s hardware event in Brooklyn, Apple’s chief executive officer Tim Cook shared that the company’s Mac business had grown to 100 million monthly active users — a big accomplishment for the nearly 10-year-old product. Cook also showcased the new MacBook Air and introduced the new …read more

Source:: TechCrunch Gadgets

Previous post

Previous post

Next post

Next post