Signing up for a typical UK-based ID theft protection service will give you access to your credit report, but only from one credit agency – usually Experian, Equifax or Callcredit. These are usually very similar, but there are likely to be differences.

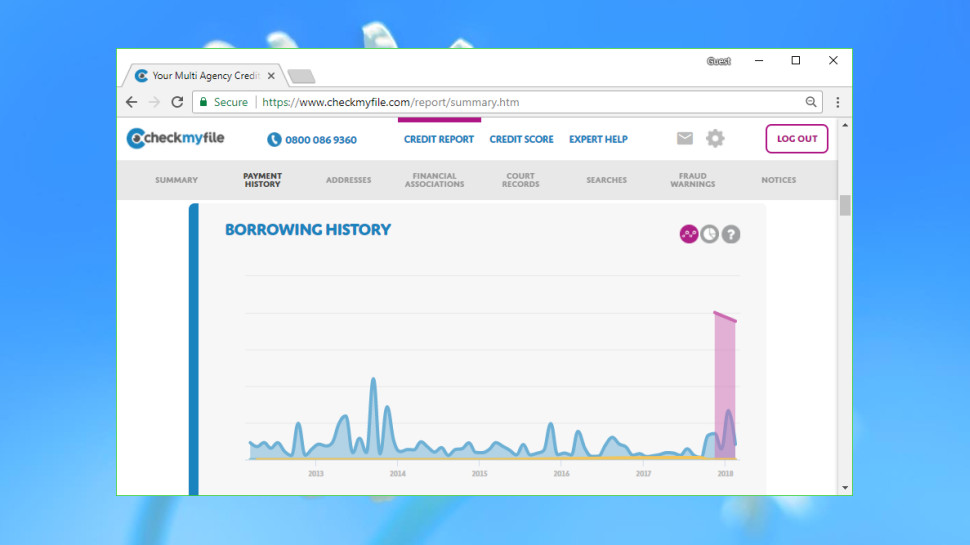

Checkmyfile takes this to the next level, combining your credit report details from Experian, Equifax, Callcredit and Crediva to give you a much more rounded picture of what’s held about you online.

What you don’t get with Checkmyfile are any form of automated alerts when your credit reports change. That’s perhaps understandable – deciding when to raise alerts is going to be much more complicated when you’re looking at four reports rather than one – but it does mean that if you want to use Checkmyfile to detect identity theft, you’ll have to do it yourself.

This isn’t necessarily a fatal problem. Yes, using Checkmyfile for ID theft protection requires more work than competing services. But if combining reports from four agencies allows you to spot something that other services might miss, you could still be better off overall.

If you do fall victim to ID fraud, Checkmyfile provides a free assistance …read more

Source:: techradar.com – PC and Mac

Previous post

Previous post

Next post

Next post